If you Have Credit card? Keep these things in mind, to take benefits not loss. In this post we learn...

If you Have Credit card? Keep these things in mind, to take benefits not loss. In this post we learn...

Friends with this Bank reconciliation TDL we can add bank clearing date in ledger. This TDL file will solve your...

You can also obtain a loan on insurance policy; find out more about the unique circumstances surrounding it here. Apply...

With this Free Tally Prime TDL code to Import Stock item, we can import from Excel to Tally and also...

Today with this TDL file we generate invoice wise profit in one click. Everyone need fast and simple method to...

If we able to stop lower price billing, then can earn more and never will be in loss. If we...

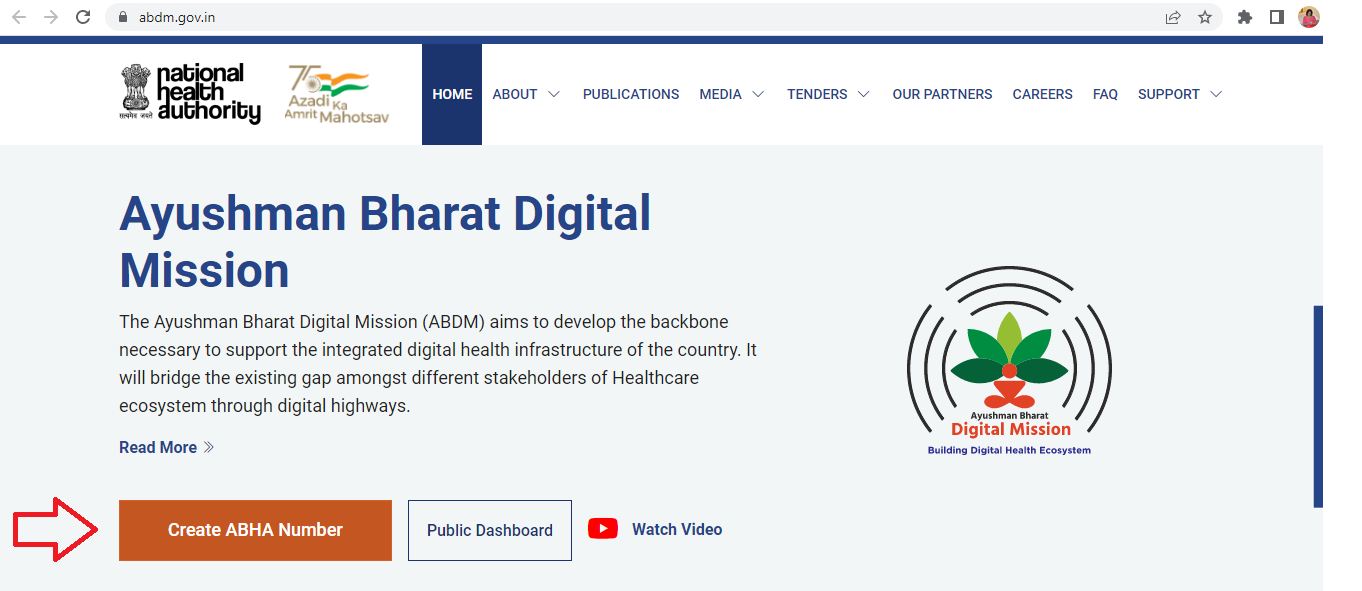

The Central Government has started Digital Health Card 2022, ie ABHA (Ayushman Bharat Health Account) under Ayushman Bharat Digital Mission....

Today I have best free Tally Prime TDL for your Tally to add GST and Mobile number in Voucher Screen...

Liz Truss, a 47-year-old British politician, will take over as prime minister. Sunak, an Indian-born sage, was vanquished by him....

Panchsheel Nagar East, BMY Charoda, Bhilai, Chhattisgarh

+91 -9131810293

learnwell.e2t@gmail.com