In the GST regime, it is compulsory to mention the HSN code in all the invoices issued by a business. The HSN code is a unique identification number that is assigned to every product. It is a standardised system of classifying products and is used by all businesses that are registered under GST.

The HSN code is used to determine the GST rate that is applicable to a particular product. It is also used for filing GST returns and for other compliance purposes. In Tally Prime, the HSN/SAC code and GST can be entered in the voucher entry screen itself.

This Free Tally TDL to add HSN/SAC And GST Details in Voucher Entry can help you to create a perfect invoice. You may view all GST rates and Item HSN codes by using this GST detail TDL, which will be highly beneficial to you.

Table of Contents

ToggleTally TDL Code to add HSN/SAC And GST Details in Voucher Entry:

We can modify this TDL code according to our need. We can add some additional fields, we can remove extra fields, and it is must have TDL code for Tally Erp9 and Tally Prime. Best simple Tally TDL to add HSN/SAC And GST Details in Voucher Entry

[#Line : EI ColumnOne]

Option : Global EI ColumnOne

[!Line: Global EI ColumnOne]

Add : Right Fields : At Beginning : IAHSNcodeT, IAMVAT

[Field : IAHSNCodeT]

Info : "HSN/SAC Code"

Align : Centre

Width : 15

Style : Small bold

[Field : IAMVAT]

Info : "IGST%"

Align : Centre

Width : @@NumberWidth

Style : Small bold

[#Line : EI ColumnTwo]

Option : Global EI ColumnTwo

[!Line: Global EI ColumnTwo]

Add : Right Fields : At Beginning : IAHSNcodeT, IAMVAT

Local : Field : IAHSNCodeT : Info : " "

Local : Field : IAMVAT : Info : " "

[#Line : EI InvInfo]

Option : Global EI InvInfo

[#Line : CI InvInfo]

Option : Global EI InvInfo

[!Line: Global EI InvInfo]

Add : Right Fields : At Beginning : IAHSNCode, IAMVA

[Field : IAHSNCode]

Use : Short Name Field

Set As : $GSTHSNCode:StockItem:$StockItemName

Align : Centre

Border : Thin Left Right

Width : 15

Skip : YES

[Field : IAMVA]

Use : Number Field

Set As : $GSTIGSTRate:StockItem:$StockItemName

Format : "NoZero, Percentage"

Align : Centre

Border : Thin Left Right

Skip : YES

;;=====HSN-SAC CODE IN VOUCHER ENTRY

[#Collection: List of Stock Items]

Use : Alias Collection

Title : $$LocaleString:"List of Stock Items"

Type : Stock Item

Fetch : Name

Report : Stock Item

Variable : SStockItem

Trigger : SStockItem

IsODBCTable : Yes

;;Unique : $StockItemName

Add :Format :$GSTIGSTRate

Fetch:GSTIGSTRate

Add :Format :$GSTHSNCode

Fetch:GSTHSNCode

;;TO SHOW GST DETAILS IN STOCK SUMMARY

[#Collection: List of Stock Items]

Add:Sub Title :"Item Name"

[#Collection: List of Stock Items]

Add:Sub Title :"GST"

Add :Format :$GSTIGSTRate

Fetch:GSTIGSTRate

[#Collection: List of Stock Items]

Add:Sub Title :"HSN/SAC"

Add :Format :$GSTHSNCode

Fetch:GSTHSNCode

[#Collection: List of Stock Items]

Add:Sub Title :"CL Qty"

;;=====END OF CODE========

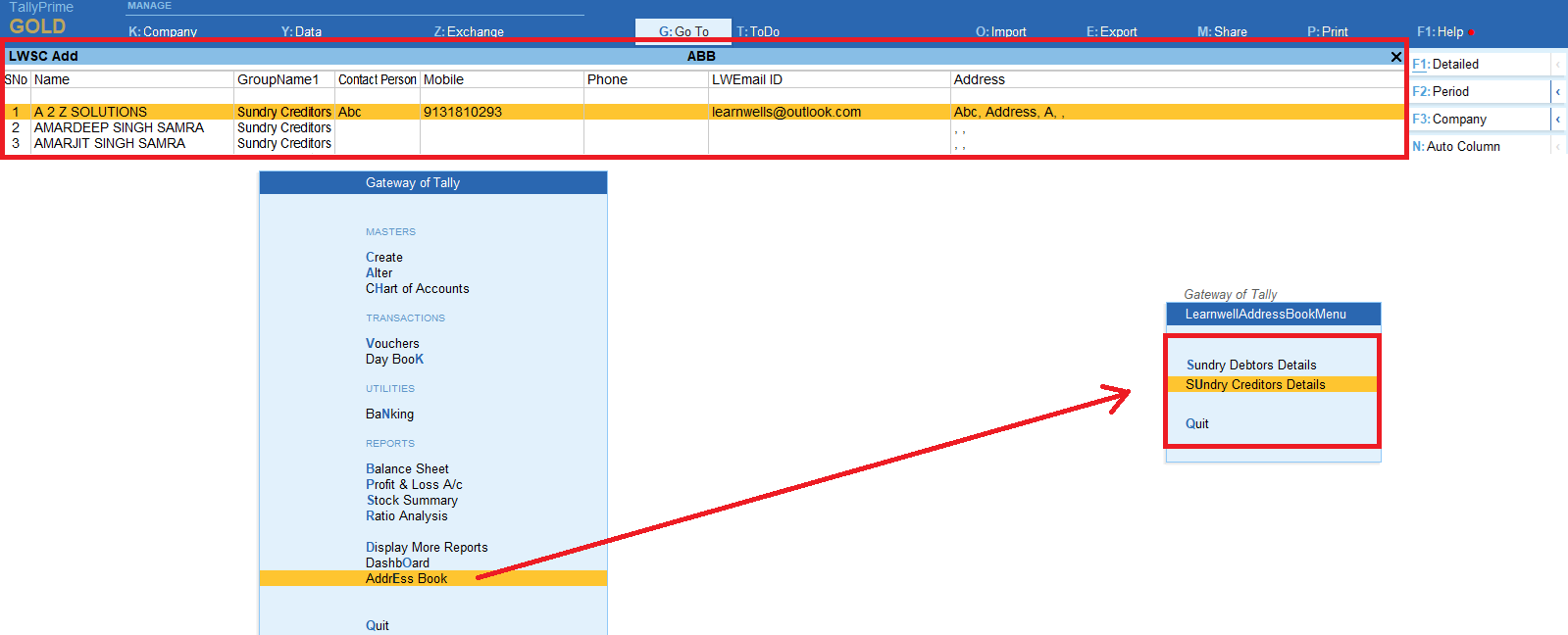

How to use HSN/SAC And GST Details in Voucher Entry TDL:

HOW TO USE TDL to add HSN/SAC And GST Details in Voucher Entry :

- Copy above TDL code and make a text file.

- Save text file then load in Tally Prime or in Tally ERP9 (Method provided below the code)

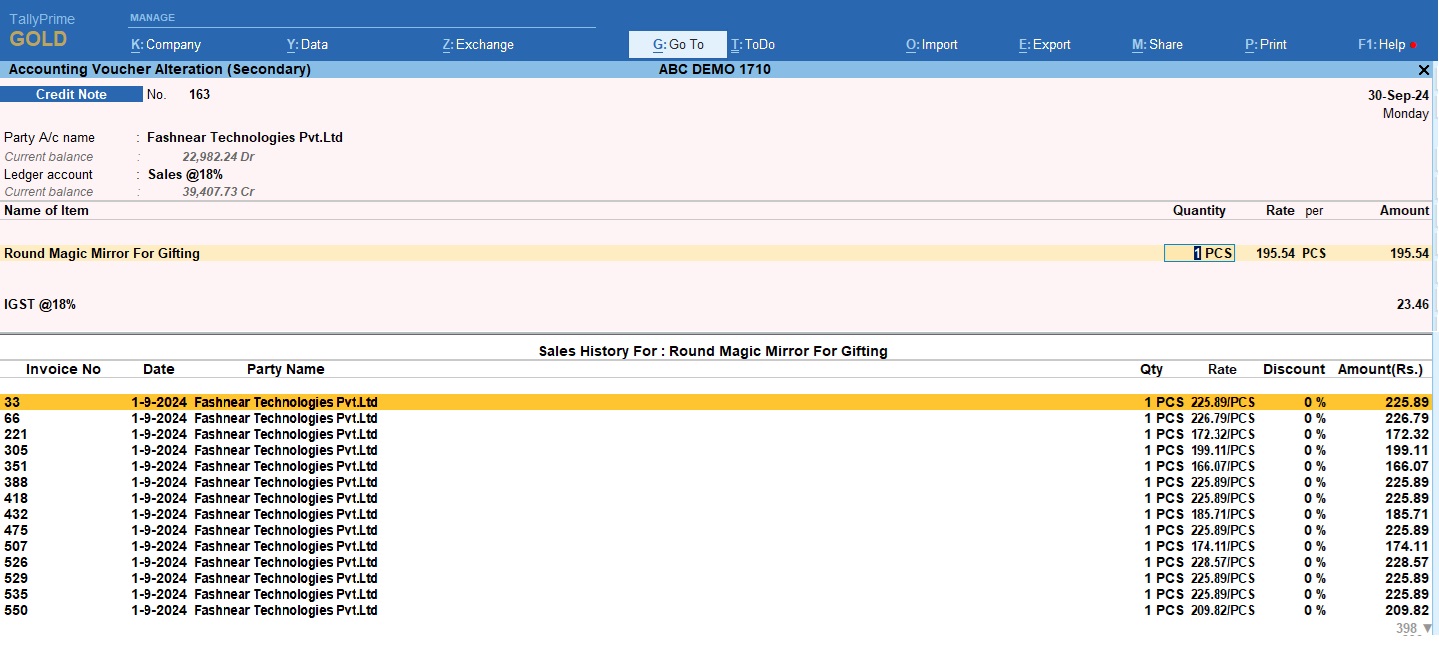

- Now go for invoicing and select item, you will find HSN code and GST rate of Items.

Also get TDL to replace Ledger and Item Name in Voucher

This is best free TDL to have in your Tally . Must have TDL file for Tally ERP9 and Tally Prime that can use for lifetime. This free TDL Code will perfectly work with Tally Prime.

How to use HSN/SAC And GST Details in Voucher Entry TDL video:

Find more videos on Youtube.com@learnwell

Watch above video to learn :

- How to use TDL file in Tally Prime.

- How to see HSN and GST detail in Voucher Entry.

- How to modify voucher with TDL code.

FOLLOW THE BELLOW INSTRUCTIONS: HOW TO LOAD TDL FILE IN TALLY:

- Make a Text file of above code

- Save it in to your computer

- Copy the text file path including Name and extension (as – C:\Users\HP\Desktop\rec\replace tdl.txt)

- Open Tally Prime Software

- Click on Help and click on TDL & Addon (for Tally Prime)

- Press F4 (to open a Box)

- Set Load TDL file on Startup – Yes

- Paste The path in blank space

- Press enter and save

- Now your HSN/SAC And GST Details in Voucher Entry tdl is ready to use.