Friends, we all work hard, but many times we do not get the result of that hard work properly or it takes time to get the result, due to which our work is not completed at the right time. And similarly, when we prepare our books in Tally, many times due to the error in GST, we do not file our return on time and we have to face many problems. As you know that we have to submit GST properly at the right time and that too without any mistake.

Friends, we all work hard, but many times we do not get the result of that hard work properly or it takes time to get the result, due to which our work is not completed at the right time. And similarly, when we prepare our books in Tally, many times due to the error in GST, we do not file our return on time and we have to face many problems. As you know that we have to submit GST properly at the right time and that too without any mistake.

And if your business is related to e-commerce then you have to face more problems.

So today we will know what are the important things to keep in mind in any business so that there is no error in GST, whether it is GSTR1 or GSTR2 or GSTR3B, our work gets completed on time.

Table of Contents

ToggleSo the things we have to take care of at entry time can be divided into 2 parts:

- Which things to keep in mind when create Masters.

- Which things to keep in mind when create Vouchers.

Which things to keep in mind when create Masters:

When we create master, whether it is ledger master or stock master, we should take care of some things related to GST which are as follows:

Ledger Master Creation:

- Things to do in Ledger Master Creation of Sundry Debtors and Sundry Creditors:

- Things to do in Ledger Master Creation of Sales and Purchase Accounts:

- Things to do in Ledger Master Creation of GST and TCS, TDS:

- Things to do in Ledger Master Creation of Expense and Income Ledgers:

Things to do in Ledger Master Creation of Sundry Debtors and Sundry Creditors:

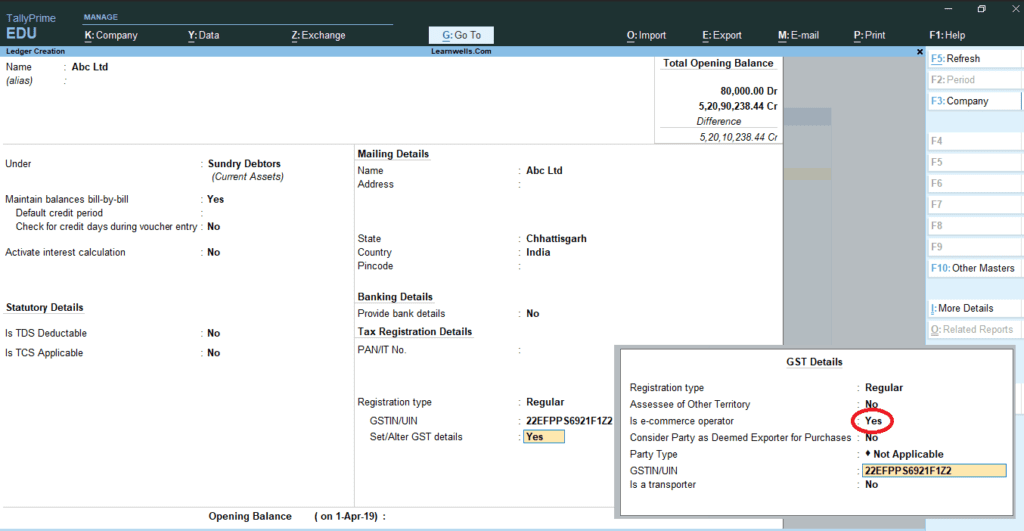

Do the below settings in Tally Ledger creation for normal debtors or creditors ledger and also for E commerce debtors.

- Set Country and State Name

- Set GST Type Regular or Consumer

- Write correct GST Number even verify from GST Portal

- For E commerce set E-Commerce operator – Yes in Set/Alter GST details

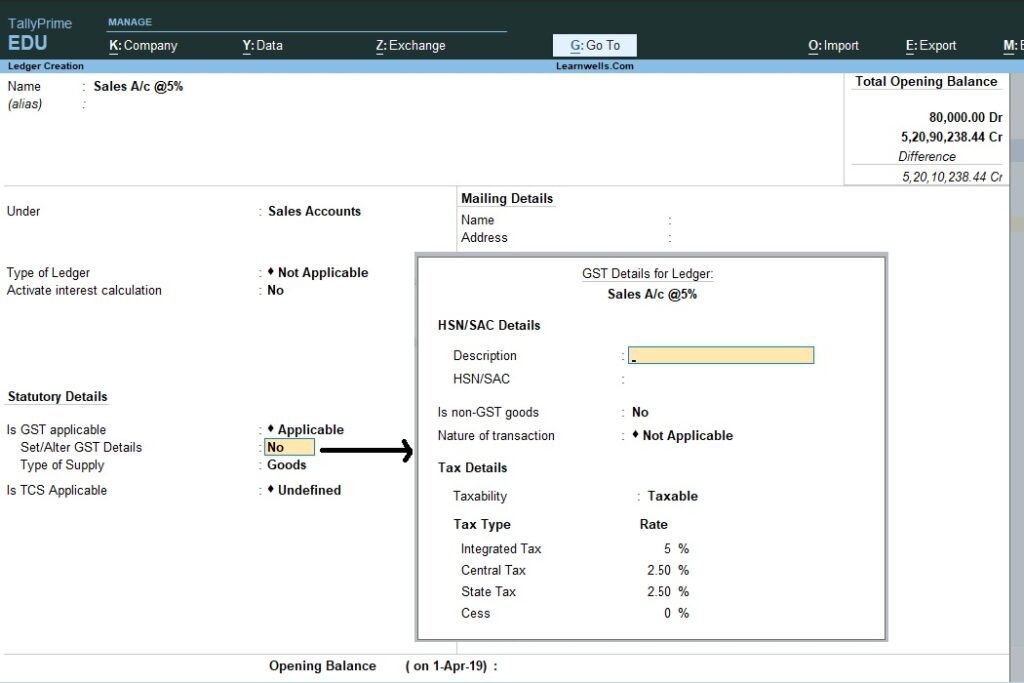

Things to do in Ledger Master Creation of Sales and Purchase Accounts:

Do the below settings in Tally Ledger creation for Sales or Purchase Accounts Ledger for with stock item and Without Stock Item.

- Create Sales or Purchase Ledger under group Sales Accounts or Purchase Accounts

- Sales or Purchase Ledger create GST type wise like Sales @5% etc., this will help to decide different GST percentage in Ledger. If maintain item wise sales only then can create only single Sales Accounts also because your GST percentage already in items GST. But creating different names according to GST percentage is good practice.

- If accounts maintain without item then keep different percentage ledgers and always put GST %, HSN.

- If accounts maintain with stock item then no need to put GST % and HSN etc in Ledger, Just set GST Applicable – Yes. If you want can put GST %.

- Nature of Transaction always keep Not Applicable. Because if you set it Applicable then you need to create two different ledgers – One for CGST and SGST and Second for IGST because you can only choose One nature of Transaction a Time.

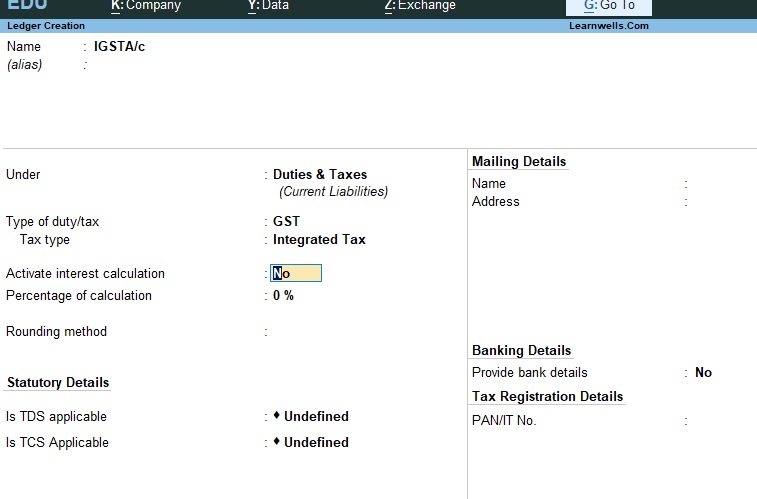

Things to do in Ledger Master Creation of GST and TCS, TDS:

- You can create a single ledger of IGST, CGST and SGST. No need to create multiple ledgers or percentage wise ledgers because your GST will calculate on basis of Taxable Ledger (Sales or Purchase accounts) and Items. If you create multiple percentage wise GST Ledgers then also no problem.

- Keep percentage of calculation zero, because already we have decided in Taxable Ledgers.

- Choose Group – Duties & Taxes and Type of Tax – GST and Integrated Tax for IGST, Central Tax for CGST, State Tax for SGST.

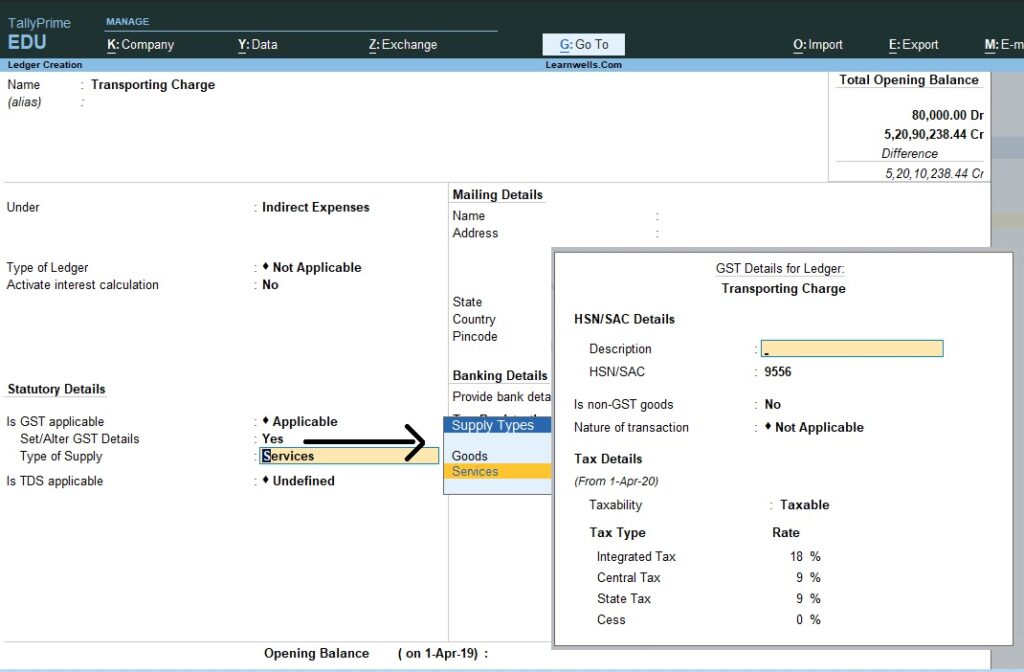

Things to do in Ledger Master Creation of Expense and Income Ledgers:

- Create Ledgers under group Expense or income as per your requirement

- Set GST Applicable – Yes

- Set Type of Supply – Services

- Set GST Applicable – Yes

- Set HSN and GST percentage

- Set Nature of transaction – Not Applicable because of need to do IGST and CGST transaction for same ledger

Item Master Creation:

- Unit Creation

- Item Creation

Keep below things in mind when create Item master:

- Fill item full GST details with HSN and GST percentage

- Fill UQC name in Item Unit cretation

Which things to keep in mind when create Vouchers:

When we create master, whether it is Vouchers with Inventory or Vouchers without inventory we should take care of some things related to GST which are as follows:

Voucher Creation:

- Things to do when create vouchers with Inventory

- Things to do when create vouchers without Inventory

We need to care same things about vouchers with inventory or vouchers without inventory. Only difference is in inventory vouchers we add stock item in invoice that have GST details in Item master. And in without inventory vouchers we add only taxable ledger that have GST in it.

Other than this we can follow below things for both with inventory or without inventory vouchers to create a proper GST invoice or GST vouchers without any error:

- For any voucher keep voucher number less than 16 digit

- Select Party name then fill party details properly like, buyer details with full GST details and State, Place of Supply. and Consignee details with full GST details and State.

- Can change consignee state etc. according to you need. Also change consignee state name for E commerce operator.

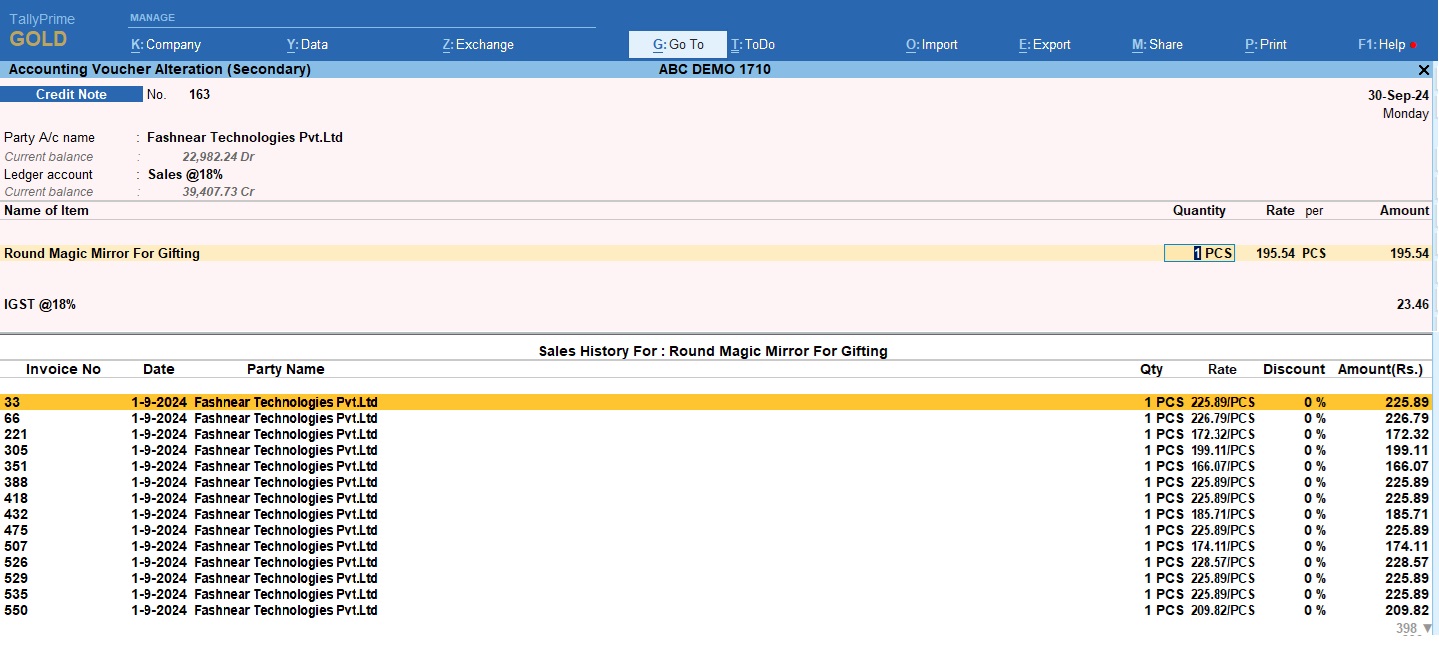

- For credit note keep voucher number and voucher date of sales in original sale details (Go to more details in Tally sidebar to fill original invoice details

- Sale for purchase voucher fill supplier invoice reference number and date.

- For Journal vouchers or Income or Expense vouchers also fill party GST number and state to prevent error in GSTR2 (Go to more details in Tally side bar to fill party details)

After doing above settings and voucher entry your 99% GST related errors will be solved.

If also face below type errors in GST reports the follow below method to resolve it:

- Mismatch due to ta amount modified in voucher – If amount mismatch is less than 1 rupee then select all transaction by pressing ctrl+space and use except as is button from Tally side bar. if amount is bigger then check GST value in voucher and correct it as per Taxable ledger GST percentage.

- Information required for generating table wise details not provided – This error will come usually in Credit Note vouchers if you not fill Sales Voucher Number and Date in original invoice sale details. So fill Sales Voucher Number and Date in credit note invoice by clicking on More Details button provided in Tally side bar.

- Nature of transaction, Taxable value, Rate of Tax modified in Voucher – For this type error remove nature of transaction from your Taxable ledger and save it. And check GST percentage in Taxable ledger and in Item and also check State and Place of Supply in Voucher.

- UOM not mapped to UQC – This type error will come if not specify UQC in unit (Specify UQC in units like – PCS, Nos etc.)

- Country, State, not specified – Fill buyer and consignee details with State, GST and Place of Supply in voucher entry.

- Tax Rate, Tax type not specified – Fill Tax type in GST ledgers like, Integrated tax, State Tax, Central Tax etc.

- Incorrect Tax type selected in Tax Ledger – In voucher select GST Ledger according to your party state and place of supply. If you select CGST, SGST ledgers in voucher instead of IGST ledger then this error will come.

- Mismatch or incomplete HSN details – Fill HSN code in All taxable ledgers and Items.

After solving above errors you can file your GST without any worry.

Please share this post with your colleagues to help them also.

-

Convert PDF and Images to Excel Automatically with AI

Convert PDF and Images to Excel Automatically with AI. Whether you are an accountant managing hundreds of invoices or a data specialist handling complex reports, AI-powered OCR technology is your new secret weapon. USE BELOW TOOL TO CONVERT PDF OR IMAGE TO EXCEL TABLE Convert PDF and Images to Excel Automatically with AI Use this…

-

The Ultimate Excel to Tally Bank Import Utility Online

We have launched a powerful Online Bank to Tally Utility at e2t.in. This Excel to Tally Bank Import Utility Online is designed to simplify your workflow, allowing you to convert Excel bank statements into Tally-ready data in seconds. How to Use Excel to Tally Bank Import Utility Online Also check online PDF and Image to…

-

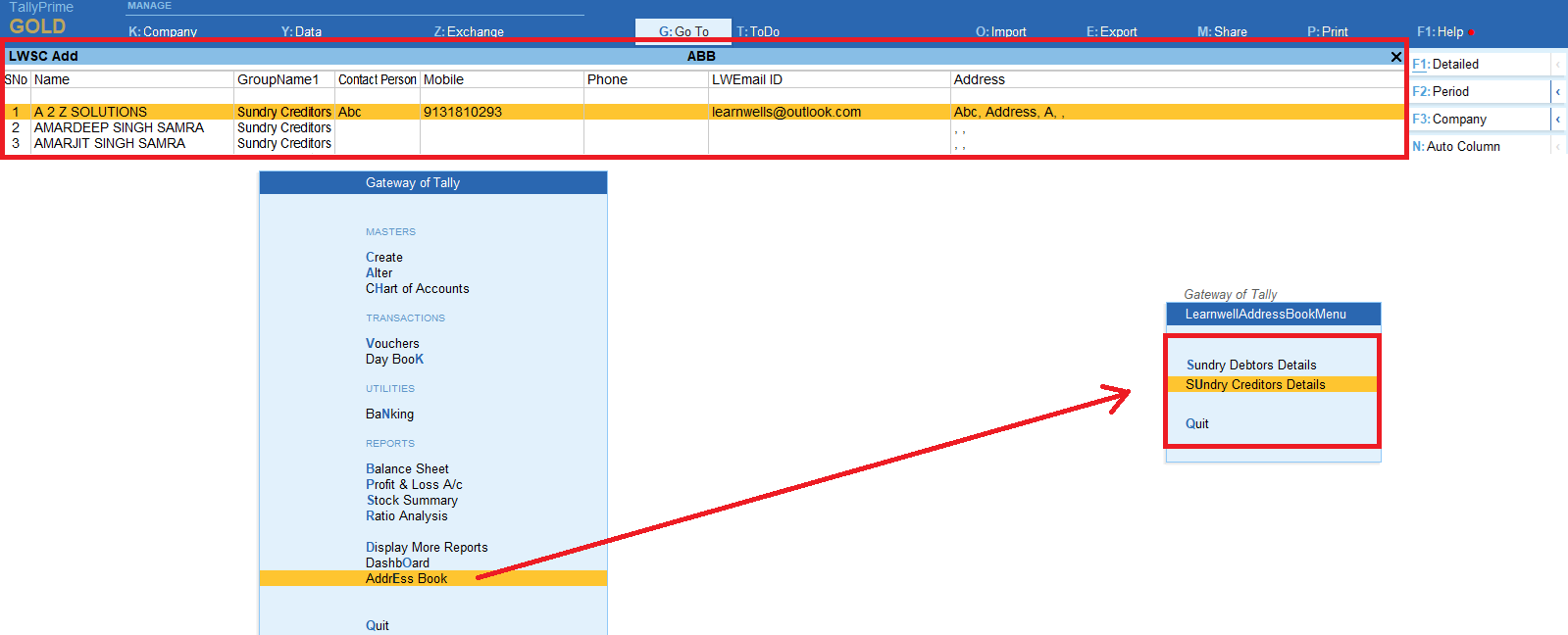

2025 Best Item Sales History Tally Prime TDL | Free Tally Prime TDL to See Item Sale History

2025 Best Item Sales History Tally Prime TDL. Tally Prime is a Best Business software, you can also use it for accounting purpose. Tally is very simple software to use but sometimes we need more flexibility and more simplicity, so we use TDL files. In Tally Prime, keeping track of item sales history while invoicing…