Friends, we all work hard, but many times we do not get the result of that hard work properly or...

Friends, we all work hard, but many times we do not get the result of that hard work properly or...

AI based software was developed by the army’s research group, Defense Research and Development Organization (DRDO), which allows for the...

We put a lot of effort into making everything great. Tally is now the most useful accounting and business software,...

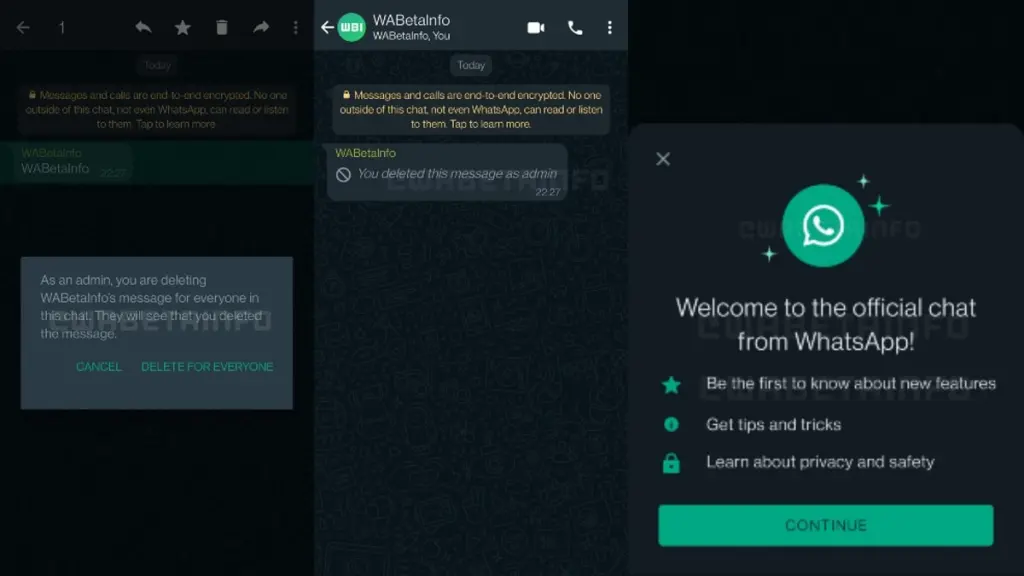

WhatsApp is developing a new feature that will make it simpler to view a contact’s status changes. According to the...

We all aware of how important is reporting in a company. There are several reporting modules available when using Tally....

UPI transactions will continue to be free. There have been rumours that the government may start charging for UPI payments,...

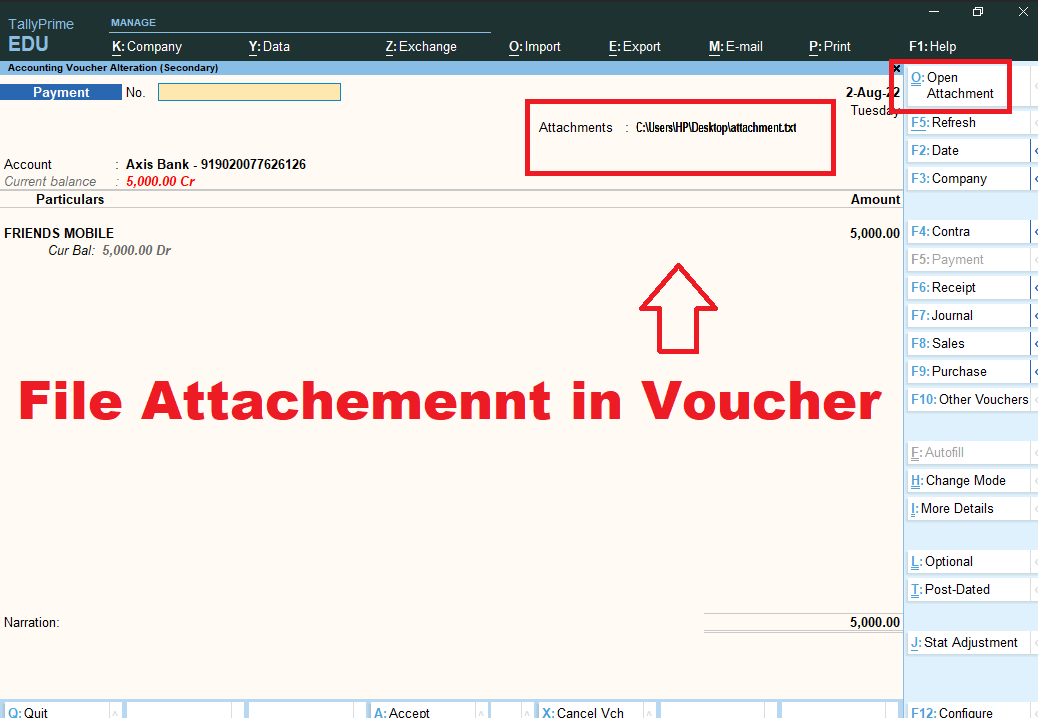

We all utilise Tally because of its easy vouching process and accurate reports. However, there are times when we need...

Your opportunity to purchase Sovereign Gold Bonds is being offered to you once more by the government. Beginning on Monday,...

Stop Master duplication in Tally TDL can boost your business performance. Tally is a most usable business software in India...

Panchsheel Nagar East, BMY Charoda, Bhilai, Chhattisgarh

+91 -9131810293

learnwell.e2t@gmail.com