UPI transactions will continue to be free. There have been rumours that the government may start charging for UPI payments, however the Finance Ministry has refuted these claims. The administration declared that UPI transactions will continue to be free. UPI transmits funds similarly to IMPS, according to a previous RBI discussion paper, hence UPI ought to be charged the same fund transfer transaction fee as IMPS.

According to the Finance Ministry, UPI is highly practical for individuals. The economy benefits as much from it. Government officials have not discussed adding fees to the UPI service. The service provider will be reimbursed for its costs in other ways, so far as that is concerned. The ecosystem for digital payments is receiving financial backing from the government.

Table of Contents

ToggleRBI’s consultation has ignited a discussion:

A few days ago, RBI asked for opinions on UPI payments and fees from the public. For this, a consultation document was also distributed. People were led to believe that the government will also charge for UPI as a result, however the Finance Ministry has already clarified everything.

UPI’s NPCI operates:

RBI is in charge of managing the RTGS and NEFT payment systems in India. The National Payment Corporation of India manages systems including IMPS, RuPay, and UPI (NPCI). Beginning on January 1, 2020, the government will enforce a framework with zero fees for UPI transactions.

Revolution with the launch of UPI:

The introduction of UPI in 2016 ushered in a revolution in the field of electronic payments. Money might be transferred immediately to a bank account thanks to UPI. Digital wallets were popular before. Wallets require KYC-like hurdles, but UPI is exempt from such requirements.

600 crore transactions in July:

600 crore transactions were made using UPI in July, according to NPCI statistics. The transaction’s value was 10.2 lakh crore rupees. UPI transactions are increasing by 7.16% month over month. The transaction value is increasing at a yearly pace of 4.76%.

Special things related to UPI:

- Fund transfers via UPI are done in real time. One application can link several bank accounts.

- You only need the recipient’s cellphone number, account number, or UPI ID to send money to them.

- UPI was created on the IMPS model. This is why you can use the UPI app for banking around-the-clock.

- The use of UPI does not need the use of OTP, CVV, card numbers, expiration dates, etc. for online purchases.

-

Convert PDF and Images to Excel Automatically with AI

Convert PDF and Images to Excel Automatically with AI. Whether you are an accountant managing hundreds of invoices or a data specialist handling complex reports, AI-powered OCR technology is your new secret weapon. USE BELOW TOOL TO CONVERT PDF OR IMAGE TO EXCEL TABLE Convert PDF and Images to Excel Automatically with AI Use this…

-

The Ultimate Excel to Tally Bank Import Utility Online

We have launched a powerful Online Bank to Tally Utility at e2t.in. This Excel to Tally Bank Import Utility Online is designed to simplify your workflow, allowing you to convert Excel bank statements into Tally-ready data in seconds. How to Use Excel to Tally Bank Import Utility Online Also check online PDF and Image to…

-

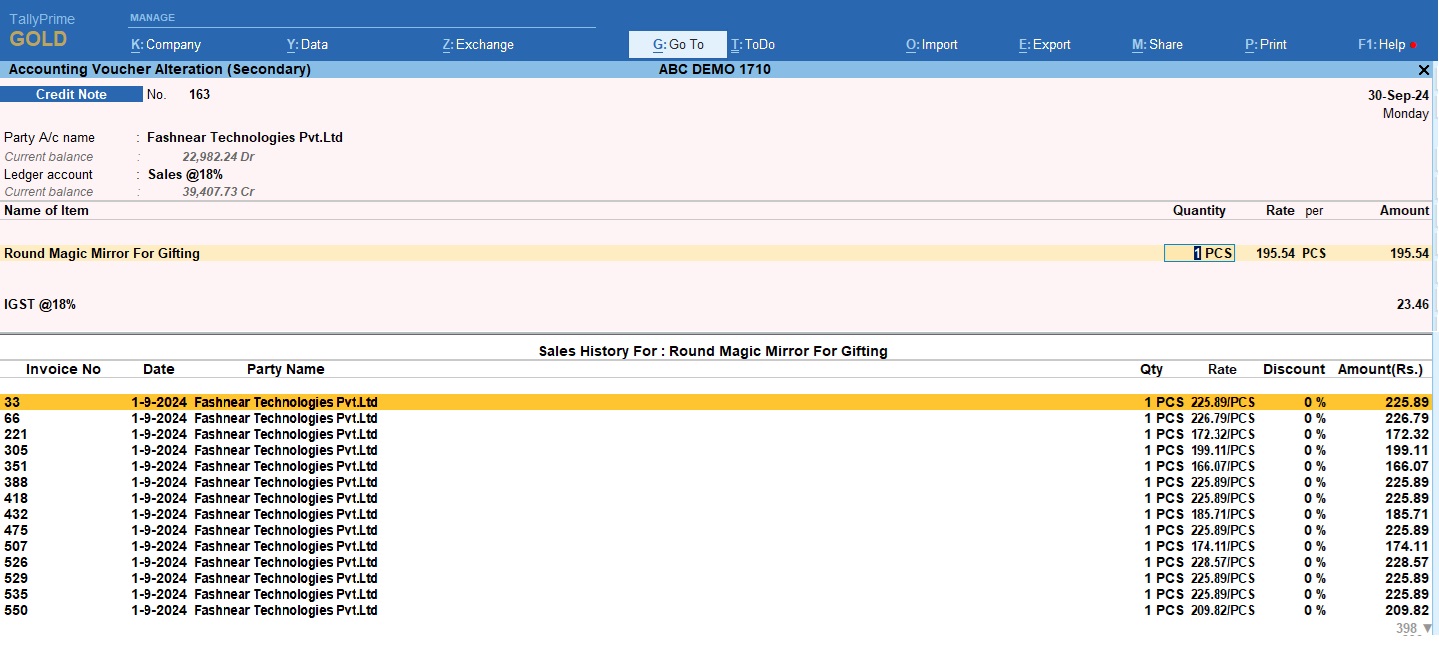

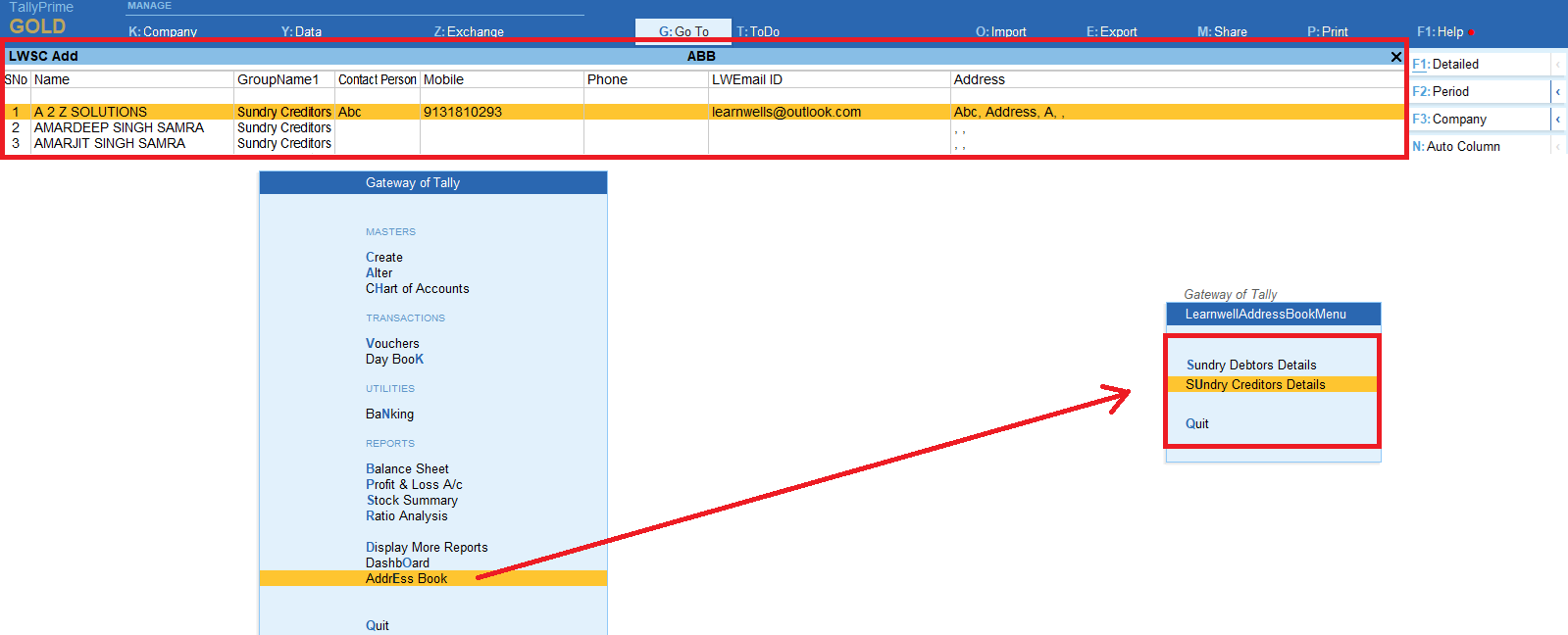

2025 Best Item Sales History Tally Prime TDL | Free Tally Prime TDL to See Item Sale History

2025 Best Item Sales History Tally Prime TDL. Tally Prime is a Best Business software, you can also use it for accounting purpose. Tally is very simple software to use but sometimes we need more flexibility and more simplicity, so we use TDL files. In Tally Prime, keeping track of item sales history while invoicing…